Helping Simply Fresh Food ride a wave of success

From café beginnings to food manufacturing powerhouse For any growing business, managing cash flow can be a challenge, and for Simply Fresh Food, navigating this volatility has been crucial to their success. "Cashflow, especially in the food business, is vital because it's a volatile game, and Earlypay helped us immensely as we grew", says the founder of Simply Fresh Food, Frank Vecchiare…

Read more

![]()

Helping Simply Fresh Food ride a wave of success

![]()

Making the switch saved Energy Technologies

![]()

Optimising Cash Flow for Growth: Labour Hire Success with Earlypay and Xemplo

![]()

Buccini Transport's Growth Journey

![]()

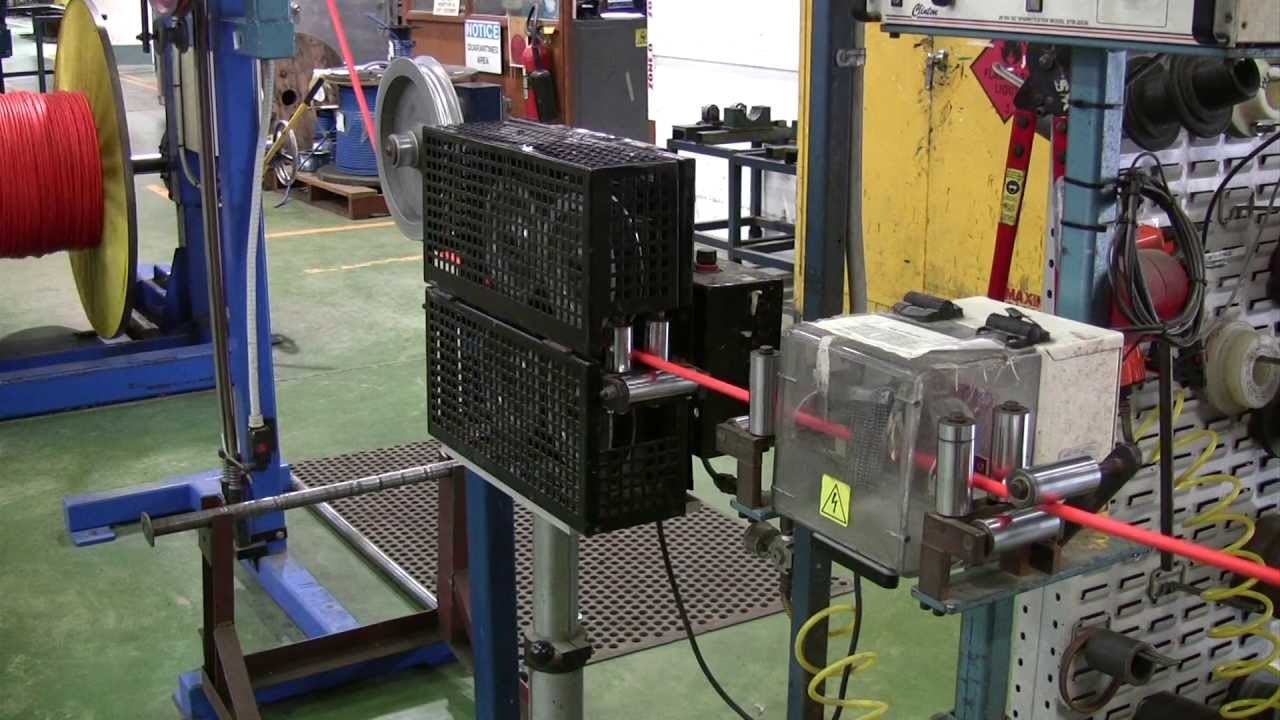

Revitalising Manufacturing Success Through Strategic Financing

![]()

Flexible Invoice Finance and Trade Finance solution for a Wholesaler

![]()

Earlypay | Helping the helpers

![]()

Asset and Invoice Financing solution for a Crane Hire Business

![]()

Invoice and Equipment Finance — An Almighty Duo