How payroll funding can smooth out fluctuations in cash flow cycles

In recruitment and labour hire businesses, there are distinct cash flow cycles that can become problematic if cash flow is not monitored and managed effectively. Identifying and understanding these cycles is essential for effective cash flow management and ensuring business stability.

We discuss some of the common cash flow scenarios the industry experiences and explore payroll funding as a cash flow solution.

Delays between client payments and payroll obligations

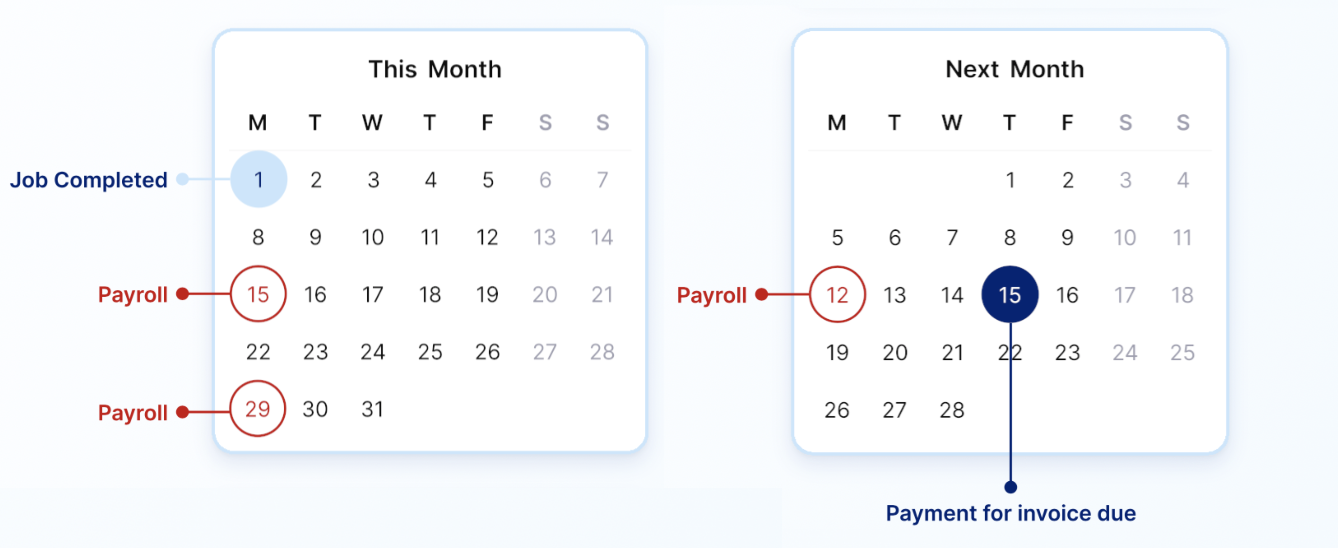

It’s common to experience a cash gap between paying your workforce and receiving payments from clients — for example, paying your workforce fortnightly, while your clients pay their invoices 45 days after the work is complete. This delay can create significant cash flow challenges, as payroll obligations must be met regularly, regardless of when client payments are received. Without adequate cash reserves, it can be a struggle to maintain operations and meet payroll on time, plus all your other financial commitments like insurance, subscriptions, or rent.

Waiting weeks for your clients to pay their invoices (with credit terms potentially longer than 45 days), while you must pay your contractors within 14 days can bring about a significant cash gap, which is very difficult to bridge without the right management process and financial tools.

If you’ve just paid a contractor for work they completed two weeks ago, but your client has been offered payment terms of 45 days, you still need to wait 31 days before you’ll see any revenue come in for that particular job. This essentially leaves you out of pocket until your client pays the invoice. But your payroll obligations can’t wait!

Payroll funding as a cash flow management tool

Payroll funding allows you to pay your contractors or employees for work they’ve completed, on time, every time, while your clients have the freedom to pay their invoices according to the credit terms. Essentially, you get early access to the funds you’re expecting to receive from invoices you’ve issued to your clients.

It works like this:

- Your contractors fill in their timesheets, which are approved by your client.

- You generate an invoice for your client based on the approved timesheets.

- The payroll is processed according to your contractor timesheets.

- Payroll funding pays for the payroll batch by providing early access to funds from the invoice you’ve sent to your client.

- When your clients pay their invoice, some of the funds are used to repay your payroll finance.

For example, if you have issued $100,000 worth of invoices to various clients, you can access up to $85,000 to use to fund your payroll obligations!

Workforce management as an efficiency tool

If your workforce management and back office are not optimised, you can run into issues that make your cash flow situation worse. A common issue that makes the cash flow gap wider is when your clients do not approve timesheets in a timely manner. If you have paid your contractor before your client has even approved the timesheet, you could be out of pocket for months!

With workforce management, you can rest assured knowing your onboarding, contracting, timesheet process, payroll management and invoicing are taken care of. By streamlining your processes and administration, your timesheets are submitted and approved earlier, with invoices sent out faster, providing immediate access to funding — improving your cash flow! At Earlypay, we’ve teamed up with workforce management providers to ensure you’re well-placed to remove this administrative burden.

With improved cash flow, you can meet payroll on time, and even look at investing in the growth of your business.

Set your business up for scalability and profitability! Learn more about Invoice Finance for payroll funding today.