Like so many other business owners, you may be guilty of referring to your business as your baby. Just like human babies, startups go through different stages of life — through the business lifecycle. Knowing how to manage available sources of finances through each different phase your organisation will go through is the key to taking everything in your stride and formulating the best plan to drive your business to success.

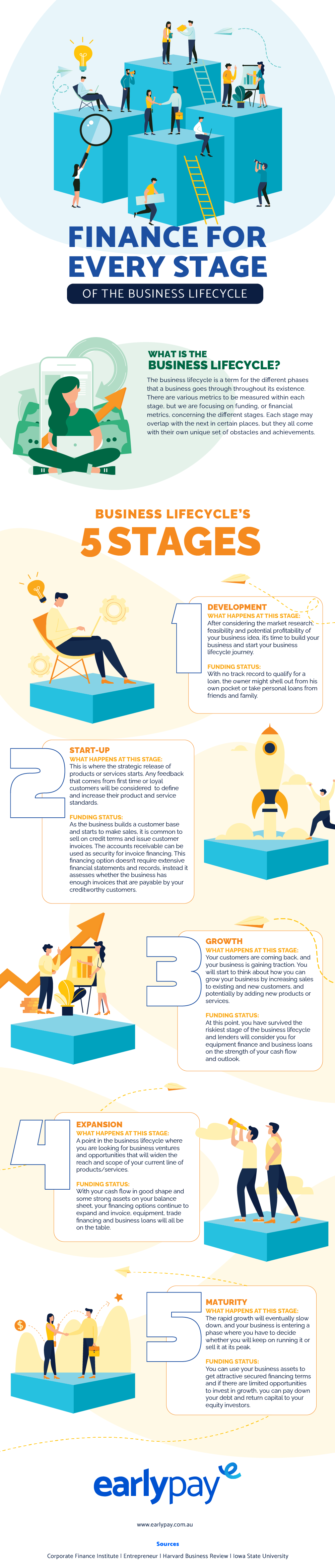

There are five business lifecycle stages — Development, Start-up, Growth, Expansion, and Maturity — and we’ll take you through each one, highlighting various financial obstacles faced by owners.

1. Development Stage

When you put out your feelers and your commercial dream begins to take shape, you are in the development stage. This is where you undertake market research and investigate the feasibility and profitability of your business idea. If you decide to go ahead, your business is born, and you begin the journey of navigating it through the business lifecycle! This is where a lot of thought will need to be put into the administrative side of things when you decide the structure — i.e. will the business be a sole trader, partnership or company? — accounting methods, marketing strategies, and defining your products or services.

But starting requires money, right? So, where does this money come from? Because the venture has no track record to display, unfortunately, it is not yet a candidate for a loan. Any sort of financing will be almost all from equity from the business owner. Borrowing money from friends and family isn’t uncommon in the development stage and any debt used is likely to come from personal credit cards. This can be an exciting and nerve-wracking time for the owner as they’re really going out on a limb to try to bring this business to life. It’s a risky time, but if it pays off, you could be on the commercial journey of a lifetime.

2. Start-up

The business is now up and running! The product or service will be rolled out with a keen eye for any feedback that comes in — after all, the customer is always right! (not always, but in this stage, feedback is very important to ensure you’re meeting the needs of your target audience).

So who is footing the bill in the start-up stage? Start-ups are still primarily financed through equity, with crowdfunding also gaining traction and becoming an increasingly popular way to raise funds. Now that the business is raising invoices, they have the opportunity to use invoice financing. While other forms of debt are still just out of reach for startups, invoice financing doesn’t require the organisation to show their financial track record — they only need to show that they have valid invoices that are payable by their creditworthy customers. Invoice financing can help manage cash flow so businesses can pay their bills and staff and purchase more inventory without relying on customers first paying their invoices.

3. Growth Phase

Now that your business is established, it’s starting to make a name for itself. Revenue starts to stabilise, and the longevity is more certain. Customer retention should be picking up as well as new customer interest.

When it comes to financing, equity can become a more accessible option than it was initially — the business has demonstrated its success. Hence, investors are more willing to purchase equity at a higher valuation. Asset and equipment finance may become an option if the organisation has at least one year of financials to show that they have the capacity to repay a loan. Investing in equipment can give a business what it needs to fast-track growth. Secured or unsecured business loans may become an option now that you can display credibility and capacity to repay a loan.

4. Expansion Stage

With your brand becoming a household name, it is now possible to gain more market share and move into new markets, which will increase revenue. After fine-tuning your offering in the growth phase, the framework for expansion has been created.

Purchasing additional equipment may be on the cards to increase your output or venture into different markets. Equipment loans can be a quick, easy and affordable way to finance these purchases without having to offer up a share of your ownership with equity funding. Increasing your staff or inventory size can easily be covered with invoice finance or even an overdraft from the bank.

5. Maturity

Once a business has matured, it has finished going through rapid expansion. Growth is still possible, but it may be at a reduced rate as you’ve already gained a significant share of the market. This could be the time where you, as the owner, think about an exit strategy — you could continue to run your organisation and receive dividends or sell it now that it is booming and more valuable.

Financing with debt can be a lot more cost-effective in this phase; banks may offer loans to the business, which could be cheaper than unsecured business loans. The organisation may have assets to use as security for equipment financing, invoice financing and potentially real estate to lower the cost of finance.

Key Takeaways

No matter what stage of the lifecycle your business is in, there are always forms of financing available to help you grow and reach your commercial goals. With services like business funding and invoice finance in Australia, Earlypay can help your organisation to navigate financial roadblocks. We offer flexible business loans that can provide your organisation with the funding necessary at each business lifecycle stage. Ask us about our financing options today.

If you'd like to learn how Earlypay's Invoice Finance & Equipment Finance can help you boost your working capital to fund growth or keep on top of day-to-day operations of your business, contact Earlypay's helpful team today on 1300 760 205, visit our sign-up form or contact [email protected].