Managing your accounts receivable in 2021 - Part 2

As we discussed in part-one, while delayed payment on accounts payable is often accepted among the business community as a fact of life, it can have serious ramifications on small businesses.

A shortage of cash could potentially mean that the viability of your business is at stake. The Australian Bureau of Statistics reports that more than 60 per cent of small businesses fail within the first three years. Of these insolvencies, Australian Securities and Investments Commission (ASIC) report that almost half of the businesses suffered from inadequate cash flow.

One of the key culprits to this inadequate business cash flow issue is late payments. According to a Payment Times and Practices Inquiry conducted by the Australian Small Business and Family Enterprise (ASBFEO), Australia has the longest period of late payments in the world at an average of almost 27 days in 2016.

However, there are principles that you can put in place in your business to reduce the risk of cash flow issues. Identifying payment problems early, and using best practice accounts receivable measures, is critical to business longevity. Below, we discuss everything you need to know on best practice principles for payment plans, communication, record keeping and collections.

Provide payment options

In the digital age, there are a variety of ways to accept payment. So, being flexible and providing greater choices for your customers is more likely to translate into efficient payment. Try to have more than one payment method on your invoice, including credit or debit card, phone and online payments. Cloud-based accounting platforms like Xero offer the ability for customers to make payments through credit card (Stripe and Paypal), direct debit (GoCardless) and Apple Pay, so ensure that you include relevant options in your invoice settings.

Follow-up

Monitoring and following up overdue invoices is a critical part of both running a business and exercising best practice accounts receivable management. If you’re not chasing overdue invoices, you’re giving your customers a license to pay late. Remember, as we discussed in part-one, these businesses are essentially borrowing money from you interest-free. As soon as an invoice becomes overdue, it’s important to gently follow-up with your customer. This allows you to both be proactive and identify areas of concern.

To manage accounts receivable effectively, it’s important to have a good relationship with your customer’s accounts payable team. The gold standard is to follow-up on the phone if a payment hasn’t been received within one or two days after the due date. This gives you an opportunity to check that everything is accurate and get confirmation about if and when it will get paid.

Follow-up emails are easy but not always effective as they don't provide the same level of engagement as speaking to someone. Speaking directly to the customer over the phone or in person is the best way to maintain a positive customer relationship and resolve the payment problem as quickly as possible. If you do plan on charging late fees, ensure that you exercise empathy as you don’t want to affect client relationships.

If you’re working with a big corporate customer, ask if they have a supplier portal that you may access to review the status of your purchase orders. This will make it easier for you to track your approved invoices without the hassle of following-up the often busy accounts payable team.

Some small business owners feel uncomfortable or guilty about following up unpaid invoices but, remember, it’s your money and you have every right to it. As we explained earlier, it’s important to set the expectations upfront in a customer relationship so they expect to hear from you if an invoice moves past due. However, be aware of your customer’s accounts payable cycles and be accepting of their processes (within reason).

It’s also a best practice to keep the sales and collection relationships separate where possible – you don’t want your salespeople distracted by chasing payment and potentially tarnishing the relationship.

Automate reminders and keep records

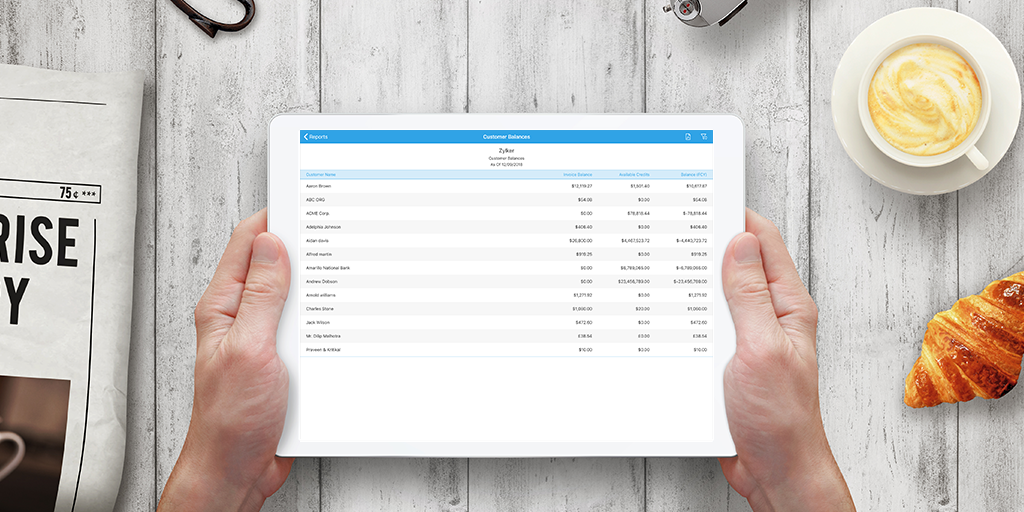

It’s best practice to review your accounts receivable reports weekly to identify overdue accounts, especially those that are more than 10 days overdue. By tracking this, you can get a great sense of your current and future cash flow position which is a critical indicator of the financial health of your business.

You should always maintain accurate records and keep a log of any overdue account, including times and dates of all emails and phone calls and the customer's response. It’s important to keep notes from discussions with your customers to ensure you have all the information and don’t ask the same questions which can be irritating for your customer's Accounts Payable team.

One of the many benefits of modern cloud accounting software like Xero, QuickBooks and MYOB is the ability to automate invoice reminders to be sent to your customers. This is an easy way to remind your customer that an invoice is overdue and should be regarded as a key tool in your receivables management toolbox.

However, keep in mind that email invoice reminders may easily be missed or ignored. As we mentioned earlier, you can’t beat picking up the phone and speaking to your client directly. Not only does this help to build rapport with your clients but, by listening to your client, you’re also more likely to uncover the root of the issue.

Consider debt collection with caution

It’s important to note that a missed payment isn’t necessarily a malicious act on the part of the customer. Sometimes it could be as simple as forgetting a date, or a problem within their accounting department such as someone being on leave. So what happens when you’ve exhausted all options and your client just isn’t paying?

In most instances, having a good relationship with your customer and communicating openly and regularly is often enough to create solutions to outstanding unpaid invoices. For example, you may explain to your customers that you won’t deliver the next order of goods and services until overdue invoices are paid. This often provides incentive for them to act quickly.

When you can’t reach a middle ground, then you may consider passing the task on to a debt collector. The Australian Government has some great tips for what to do when chasing payment, and there’s an ombudsman who you can speak with for support and advice.

However, if you do decide to go down the path of a debt recovery agency, consider the repercussions to your client relationships. You don’t want to develop a reputation for being a business that lacks empathy and is difficult to work with.

Apply for invoice finance

Even businesses with the most diligent receivables management processes sometimes need help to cover cash flow gaps. If you need help to improve your cash flow, a great way to unlock cash from unpaid invoices is to apply for invoice finance online. We can provide from $50k up to $15m in funding to eligible businesses. To find out if you qualify for Earlypay’s fair and flexible invoice finance, check out our website or call us on 1300 760 205 .