In many small businesses, the entrepreneur often bears most of the company's responsibilities and risks. They are a source of new ideas, services, and opportunities all in one. They often have to put on many hats to deal with the tasks placed before them successfully, whether for marketing, HR, sales, service, or even finance and accounting.

All businesses require a source of finance to operate, grow, and make a profit. Without appropriately timed income or assets to outlay, keeping up with ongoing expenses can become difficult and overwhelming. This can mean being unable to attain stocks and manufactured products to produce sales and quality services.

Without these opportunities, a business cannot sustain cash flow to pay off its operating expenses and wages. Failure to maintain sufficient cash flow can also result in several negative consequences such as business losses and early closure. Worst-case scenario, entrepreneurs can face bankruptcy and large debts if they do not know how to manage their finances properly.

In this guide, we'll give entrepreneurs and business owners an idea of how they can properly manage their company's cash flow to avoid the negative impacts of being strapped for cash!

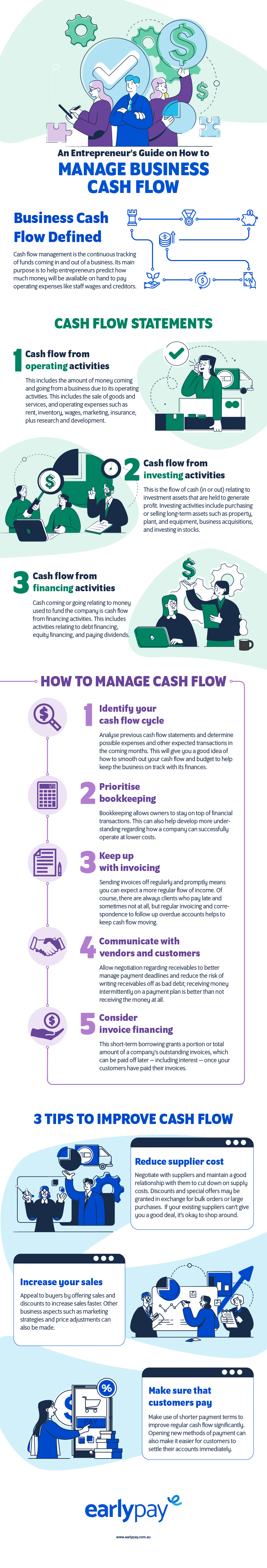

Business Cash Flow Defined

Cash flow in business is the incoming and outgoing of money — normally relating to, but not limited to, operating expenses and sales.

Your cash flow position at any point in time can either be positive or negative. Positive cash flow indicates that a company is receiving more money than it is losing through regular expenses and profit. Simultaneously, proper management of cash flow allows entrepreneurs and business owners to keep the business smoothly running along. It also helps to identify the effectiveness of things like marketing strategies.

Proper cash flow management ensures that managing parties are aware of the current standing of their business. To grow and become successful, there should be sufficient funds coming into the business to cover the necessary expenses and payments.

Cash Flow Statements

In accounting for business finance, cash flow statements are records that show changes in balance sheet accounts, income statements, and other cash-equivalent statements. The information presented on these is broken down and analyzed to understand how investments, operations, and finances are doing.

- Cash flow from operating activities (CFO)

CFO refers to the flow of money from ongoing operations. These activities can include production, manufacturing, and the selling of goods and services to its customers.

- Cash flow from investing activities

Cash flow that comes from investing activities relates to the purchasing and selling of non-current that are expected to generate profit in the future. The assets reflected in this section show how much money has been generated through business investments made previously, such as capital expenditure and any loans the business has made.

- Cash flow from financing activities (CFF)

CFF refers to the net flows of cash used to fund the business. These activities include transactions relating to debt, equity, and dividends, which can provide significant insight into a company's financial strength.

How to Manage Cash Flow

The financial assets of your business need to be handled with attention to detail and accuracy. As you grasp the concept of different cash flow statements, it's also important to know what to do with them. Here are some tips you can start with:

1. Identify your cash flow cycle

A good way to manage business cash flow is to analyse statements from previous months and predict how they can affect future operations. This will help entrepreneurs balance out their finances and make careful decisions when paying for necessary expenses.

2. Prioritise bookkeeping

Bookkeeping allows entrepreneurs to easily track previous transactions that can help them develop better strategies to generate cash flow. These records can also be used to remind what methods a business should avoid to gain better chances of success.

3. Keep up with invoicing

Sending invoices off regularly and promptly means you can expect a more regular flow of income. Of course, there are always clients who pay late and sometimes not at all, but regular invoicing and correspondence to follow up overdue accounts helps to keep cash flow moving.

4. Talk to your vendors and customers

Communicating possible payment plans and methods can generate more cash flow. Instead of long-term payment plans, shorten the duration of when settlements should be completed. This will push more customers to pay earlier, which can generate more growth.

5. Consider invoice financing

For businesses that require immediate monetary funding, invoice financing is a popular method. Many services that offer invoice financing in Australia buy invoices for a discount and advance an amount from outstanding invoices to be repaid later on.

3 Tips to Improve Cash Flow

If you find your business on the short end of the stick after managing cash flow, how do you bounce back from this financial hurdle?

1. Reduce supplier costs

In most cases, business owners can negotiate with their suppliers regarding pricing and discounts for bulk orders. In exchange for their loyalty, both parties can make settlements faster and profit from the transaction.

2. Increase your sales

Improving other aspects other than the product itself through clever marketing strategies can boost the appeal among customers. The more popular a product or service, the more likely it is to cause an increase in sales and profits. Other companies also use sales and discounted products to turn old stock into profit quickly.

3. Make sure that customers pay

Offer several payment options to make it more convenient for customers to settle their payments immediately. Some payment options work in just seconds — if it’s easy for your customer to make payment, they’re more likely to do it earlier.

Management Towards Success

Running a business is no simple task. To have a successful company, entrepreneurs must know how to manage their financial assets properly. With that, they can avoid making decisions that may lead to significant losses. At the same time, this can help them better understand their company's strong and weak points, which can be improved later on.

Several methods can quickly improve business cash flow. Debtor Financing is among the most commonly used today because of the benefits it offers at an affordable price. These tasks can also be managed by invoice finance providers such as Earlypay who offer competitive financing options.

If you'd like to learn how Earlypay's Invoice Finance & Equipment Finance can help you boost your working capital to fund growth or keep on top of day-to-day operations of your business, contact Earlypay's helpful team today on 1300 760 205, visit our sign-up form or contact [email protected].